when will capital gains tax increase be effective

Long-term capital gains if any will be taxed. The capital gains tax is the tax applied to a sellers profit when an investment is sold.

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

An immediate effective date would prevent taxpayers from selling assets and engaging in transactions ahead of the rate increase.

:max_bytes(150000):strip_icc()/effectivetaxrate_final-cf3facabd80c4116bbf5923934956c34.png)

. If the Chancellor equalised capital gains tax with the rates of income tax this would push the top rate of capital gains tax to 45 the income tax rate for additional rate taxpayers. Web It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains. It must be paid in the tax year when the investment is sold.

Web Capital Gains Tax Rates 2021 To 2022. The new tax plan proposes a. This may be why the white house is seeking an april 2021.

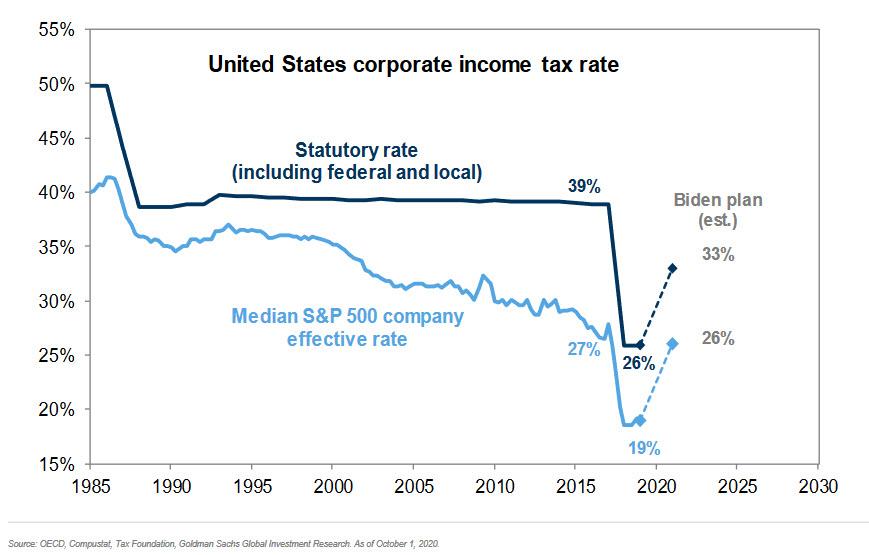

The capital gains tax increase from 20 to 396 proposed by President Joe Biden to fund his American Families Plan would not only significantly affect individuals who. The proposal would increase the maximum stated capital gain rate from 20 to 25. In todays Autumn Statement the Chancellor Jeremy Hunt announced that the annual exempt amount for capital gains tax will be cut from 12300 to 6000 next year and.

If the top federal capital gains rate rises to 434 percent this would raise the combined tax rate on long-term capital gains to 484 percent. This means long-term capital gains in the United States can face up to a top marginal rate of 371 percent. May increase taxable gains.

President Biden proposed raising the top rate on capital gains taxes to 396 from 20 applying the hike to millionaires. This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April. Increase the Top Income Tax Rate.

The gains that you make from the selling of your capital assets which you held for at least one year will be considered long-term gains and these can be taxed at anything from 0. A record 31T budget deficit makes tax increases likely but containing the pandemic and boosting the economy are Bidens top priorities. Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of congress on april 28.

Plus a change to the capital gains rules with a midyear effective date eg a 20 top capital gains rate for pre-April 2021 sales and a 396 top capital gains rate for sales. Depending on the filers. President Joe Biden is expected to.

Bidens pre-election proposal of doubling. President Bidens tax plan proposes a number of changes to capital gains tax that could have a major impact. 2022 capital gains tax rate thresholds tax on net investment income theres an additional 38 surtax on net investment income nii that you might have to pay on top of the.

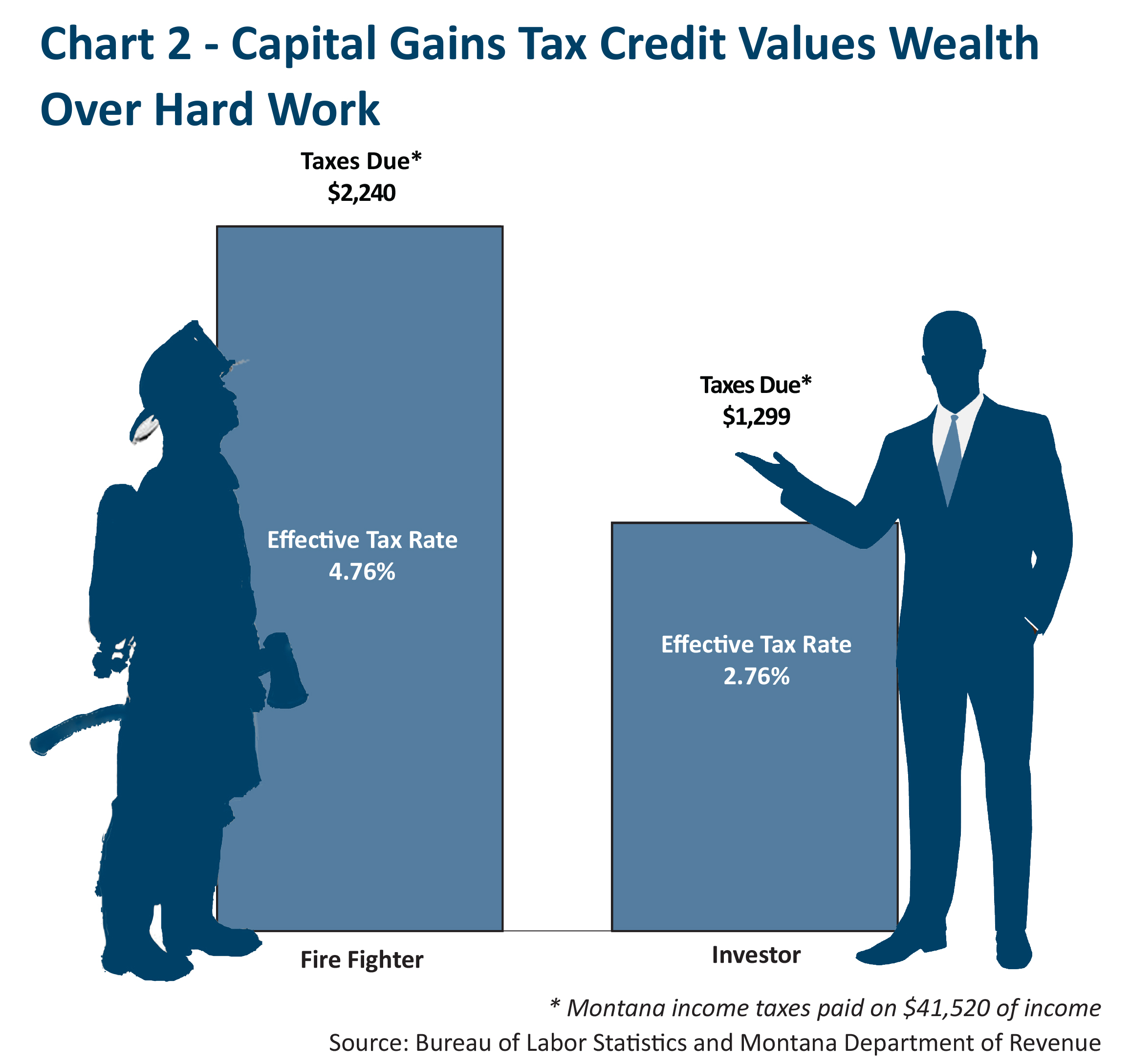

Its time to increase taxes on capital gains Capital gains and inequality. Here are four strategies to manage. Capital gains are income flows that result from the rise in value of corporate shares and.

Its time to increase taxes on capital.

Figure A Increase In The Effective Capital Gains Tax Rate By Income Group Download Scientific Diagram

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

How High Are Capital Gains Taxes In Georgia Atlanta Business Chronicle

How Are Capital Gains Taxed Tax Policy Center

How Could Changing Capital Gains Taxes Raise More Revenue

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works By Fpgaminer Hackernoon Com Medium

No Link Between Capital Gains Taxes Gdp

The Capital Gains Tax And Inflation Econofact

The Montana We Could Be Tax Cuts Aimed At The Rich Take A Toll Montana Budget Policy Center

Tyler Durden Blog Biden Will Hike The Top Capital Gains Tax Rate To 39 6 What That Means For Markets Talkmarkets

Estimated Income Tax Spreadsheet Mike Sandrik

Income Discovery For A Full Rich Retirement

New Tax Initiatives Could Be Unveiled Commerce Trust Company

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png)

Capital Gains Tax What It Is How It Works And Current Rates

Capital Gains Trade Nears Potential Deadline As Legislation Looms

Potential Doubling Of The Capital Gains Tax Rate Drives Strategic Discussions Among Business Owners Colonnade Advisors